FastInvest: The Crowdfunding Platform You Can Trust

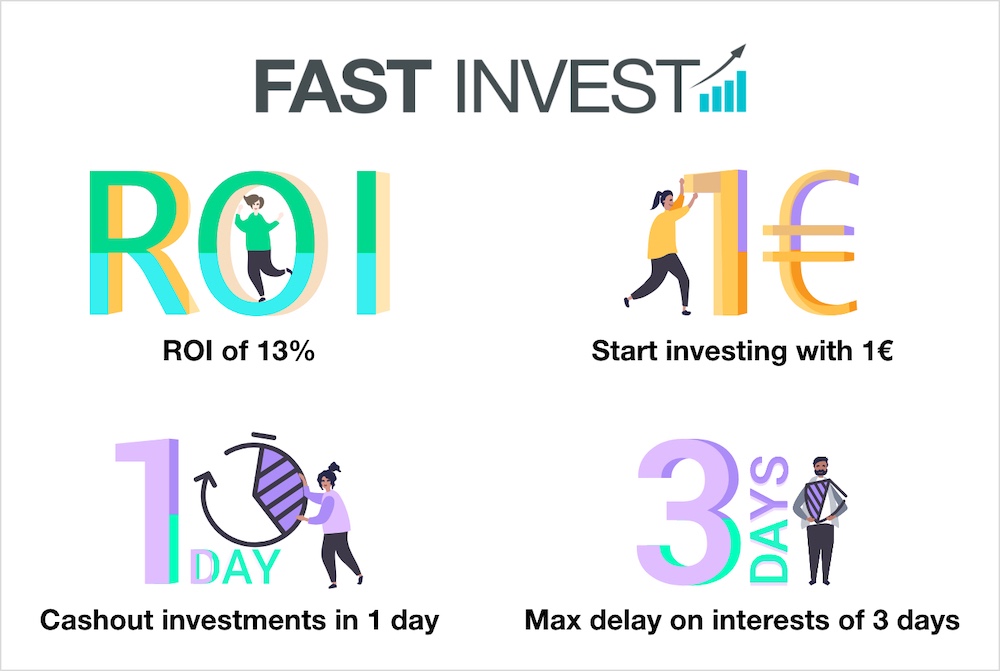

Crowdfunding is a great way to get your project off the ground, but it can be hard to know who to trust. That's where fastinvest comes in – they've been around for years and have built a reputation for being one of the most reliable crowdfunding platforms out there. FastInvest is a place where you can find and invest in innovative and exciting projects.

Invest in early-stage initiatives through funding requests from entrepreneurs and businesses. You can also support projects that are close to being launched. Invest in a portfolio of venture capital or angel investments. Manage your investments through our custom investment portal. You can also read the fastinvest analysis online.

Create your own investment portfolio by selecting individual investments or portfolios from our curated selection. Specify the amount you want to invest, the timeframe for your investment, and the types of companies you're interested in investing in (e.g., technology, healthcare, etc). You can also filter by region and industry.

FastInvest is a comprehensive crowdfunding platform that provides artists, entrepreneurs and small businesses the ability to raise money from a global community of backers. With a simple and intuitive platform, FastInvest allows users to launch campaigns quickly and easily, access critical funding resources, communicate with their backers directly and track outcomes.

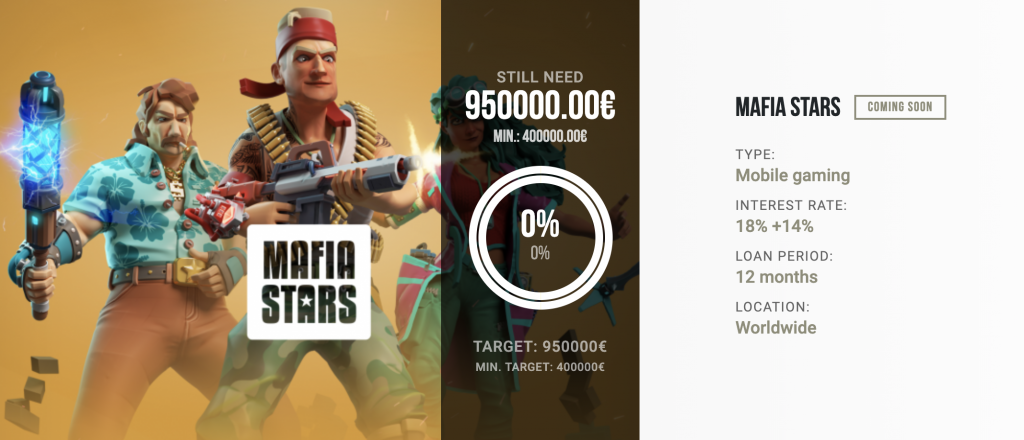

FastInvest is a crowdfunding platform that allows users to invest in early-stage and high-growth companies. The platform offers an easy way to find and invest in high-quality projects, with no minimum investment required. With FastInvest, investors can access a wide range of quality projects from around the world.